Flood Insurance

After Superstorm Sandy all of us, especially those of us in New Jersey and New York, saw firsthand how devastating a flood can be to individuals, businesses and to entire communities. But no matter where you live, you should consider purchasing flood insurance to protect your home or business. Under common insurance company and FEMA definitions, “flood” can be caused by not only heavy rain and storm surge but by a broken water main, melting snow, or even blocked storm drainage system. Most homeowners and business policies exclude coverage for  these scenarios. Coverage for flood almost always needs to be purchased separately.

these scenarios. Coverage for flood almost always needs to be purchased separately.

Experience shows us that just a few inches of water can cause tens of thousands of dollars in damage to your property. Your home does not have to be in a high-risk flood area to warrant flood insurance. In fact over 20% of all flood claims occur in low or moderate hazard areas. The cost of insurance for property not designated a high-risk area is very inexpensive.

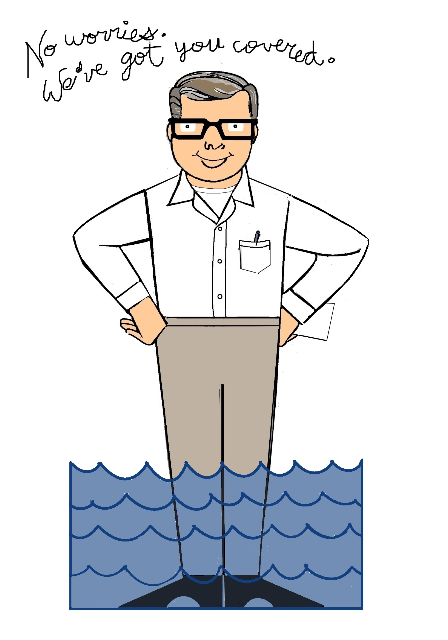

At Mile Square Insurance Agency, we have extensive experience placing flood insurance for our clients. We’ll explain what types of policies are available to you, whether you’re eligible for FEMA-backed insurance as part of its National Flood Insurance Program (we’re certified by FEMA), or private-market flood insurance. We can walk you through what is typically covered by flood policies and what is excluded. We will take the time to explain how flood policies differ from other types of insurance policies, and answer all your questions about what options are available to you.

Links

- Determine what type of flood zone you are in now.

- Contact us for a no-obligation quote for flood insurance.